June Market Insights: A Fragile Balance at the Mid-Point of the Year

May saw a return to more confidence in the economy and the markets. The Fed met early in the month, and Chairman Powell managed to curb market pessimism by stating that it was unlikely that the Fed’s next move would be a rate hike.

The reversal of the upward mini-trend of inflation in February and March, as well as other slowing economic data released throughout the month, provided a backdrop that the economy was cooling and inflation would begin to trend down again.

The Fed’s “Beige Book,” released at the end of the month, reported that national economic activity expanded during the six weeks from early April to mid-May, but the growth was largely slight or modest. Retail spending was flat, as discretionary spending was lower and consumers were experiencing heightened price sensitivity.

Let's get into the data:

CPI moved down. CPI rose 3.4% for the 12 months through April, lower than March’s 3.5%. Core CPI, excluding food and energy, rose 3.6%, moderating against the previous month’s reading of 3.8%.

Consumer sentiment dropped. The University of Michigan Consumer Sentiment Index fell over 10% in May, down 8.1 points to 69.1%. This is lower than 84% of readings since 1978, according to JP Morgan Asset Management.

Non-farm payrolls increased by 272,000 jobs in May. The Labor Department’s Bureau of Labor Statistics report was above consensus expectations. Economists had expected an estimated 180,000 jobs.

What Does the Data Add Up To?

Chairman Powell has been clear that rates could stay at the current levels for longer, until the Fed has greater confidence that inflation has meaningfully lowered, and the labor market has cooled.

This was largely interpreted to mean that a June cut was not likely, but that 2024 could still see a potential two rate cuts, possibly beginning in September.

The May jobs report, released in early June, may have put that timeline out of reach. Jobs boomed, and wages increased, indicating a still-hot jobs market. This means the Fed can continue to focus on getting inflation down by keeping rates high, as growth in the economy appears to be still supported by a strong labor market. Wage growth could mean a return to higher inflation numbers, which the Fed wants to avoid.

A small increase in the unemployment rate, to 4.0% from 3.9%, is significant because it is the first time in 27 straight months that the unemployment rate has broken 4.0%. This could indicate weakness in employment going forward.

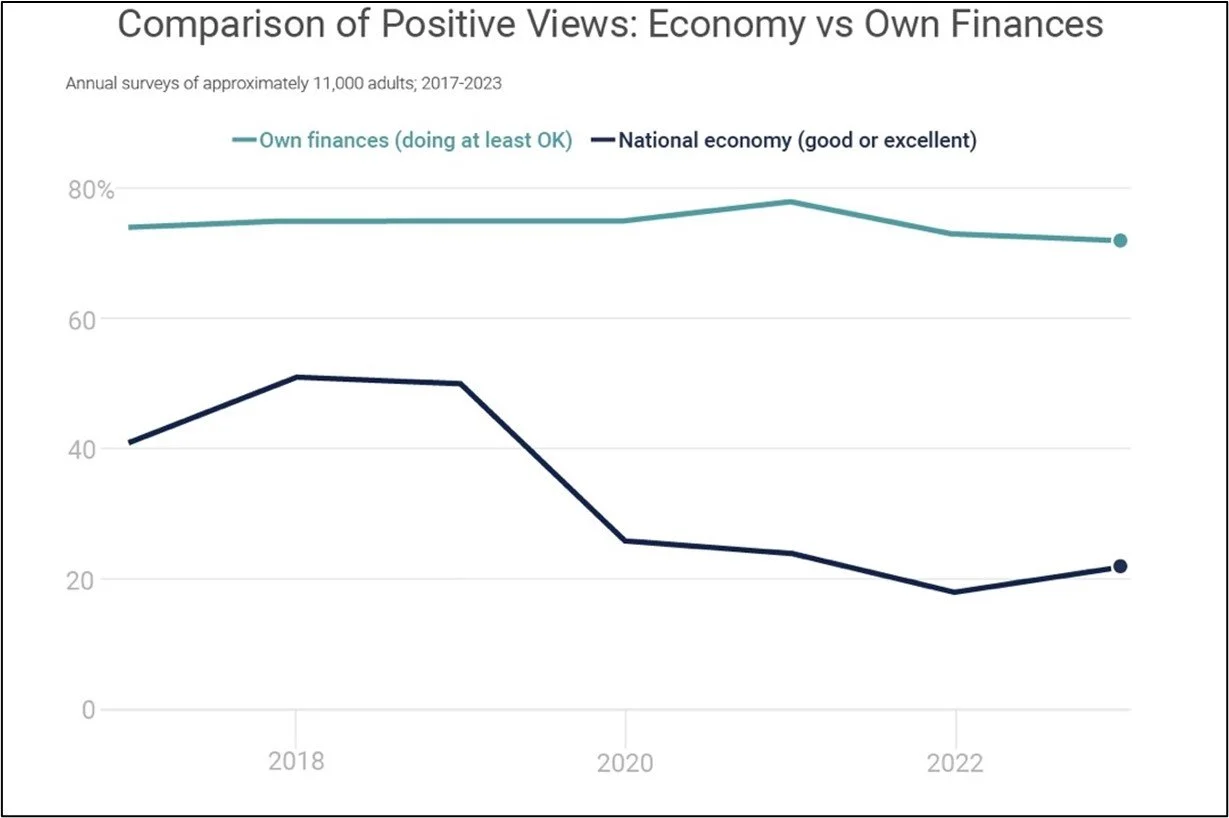

Chart of the Month: The Vibecession is Back

Most Americans who assess their own finances positively don’t feel the same way about the economy. This so-called “vibecession” can have real consequences, as it may result in slipping consumer confidence that ultimately leads to lower spending and an economic slowdown.

Source: Data: Federal Reserve Survey of Household Economics and Decisionmaking; Chart: Axios Visuals

Equity Markets in May

The S&P 500 was up 4.80%

The Dow Jones Industrial Average rose 2.30%

The S&P MidCap 400 gained 4.26%

The S&P SmallCap 600 was up 4.87%

Source: S&P Global. All performance as of May 31, 2024

Ten of eleven S&P 500 sectors gained in May. Information Technology was the strongest performer, up 9.95% for the month, and Energy was both the worst performer and the only negative, down 0.97%. After posting new closing highs in each of the first three months of the year, April saw no new closing highs. May saw a return to trend, with two new closing highs.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.51%, down from 4.68% the prior month. The 30-year U.S. Treasury ended May at 4.65%, down from 4.78%. The Bloomberg U.S. Aggregate Bond Index returned 1.70%. The Bloomberg Municipal Bond Index returned 0.29%.

The Smart Investor

The mid-point of the year is a great time to check in on your financial goals. Here's our mini-checklist of things to think about before you head for the ocean, pool, mountains, golf course, or wherever your summer travels take you:

Do a quick budget review. Is your spending at or below what you budgeted? Did you have any unexpected expenses? Summer can make it tempting to overspend, so getting a clear picture of where you are now – and making some course corrections if necessary – can avoid trouble later in the year.

Are your goals on track? Look at 401(k) savings, paying down debt, and your emergency fund or funds you are setting aside for big purchases. Are you where you want to be? High interest rates aren’t going anywhere, so paying down debt and not taking on any new debt should move up your priority list.

Market volatility will likely be with us until the Federal Reserve is comfortable with the pace of inflation, and has clear direction on interest rates. As we head into the back half of the year, reviewing your investments to maintain the risk you are comfortable with can keep you cool when volatility hits.

Keeping your finances on track with your goals is something you don’t want to think about all the time, but focusing on it now can ensure you create the flexibility you want throughout your financial journey. If you have questions, we’re always here to help.